The economy

COVID-19’s influence on economic activity has become largely immaterial by now. Notwithstanding, some impact was recently felt in China due to their zero-COVID policy shutdowns.

Inflation rose further in advanced countries to levels unexpected to most observers. A key reason for the elevated inflation is the rise in household wealth over the past two years and the consequent surge on spending for goods. Other causes include the tight labour market and lingering supply chain disruptions.

Central bankers stayed the course too long with their easy monetary policies and now must catch up by aggressively raising short-term interest rates. Mid- and long-term rates also rose further in the quarter.

The war in Ukraine carries on, limiting supply and causing prices to rise for energy in Europe and for foodstuff at large. Growth in most countries is slowing due to the inflation headwinds and declining real disposable income. Some advanced countries started showing signs of recession late this quarter.

The performance benchmark

The performance benchmark (the benchmark used to calculate the performance fee payable by the Fund) was up 1.1% this quarter. It is derived from the return of the FTSE Canada 91-Day Index, plus 3% per annum, with a floor of 4%.

The world equity market

The MSCI All Country World Equity Index (CAD) (MSCI ACWI)* is representative of the sectors to which the Fund has exposure. It is comprised of equity securities of large- and mid-cap companies from developed and emerging markets around the world. It fell 13.0%.

Weakness was broad-based with every sector posting a negative return. The main causes are high inflation and rising interest rates leading to valuation multiples compression. Falling profits are not a concern since earnings estimates for 2022 are still rising.

The worst-performing sectors were Information Technology (-19%) and Communication Services (-16%), due to higher rates reducing growth stocks valuations, and the cyclical Materials (-17%) and the Consumer Discretionary (-18%) sectors.

The best-performing sectors were Energy (-2%) as well as the defensive Utilities (-4%) and Consumer Staples (-3%) sectors.

Lysander-Triasima All Country Equity Fund (the “Fund”)

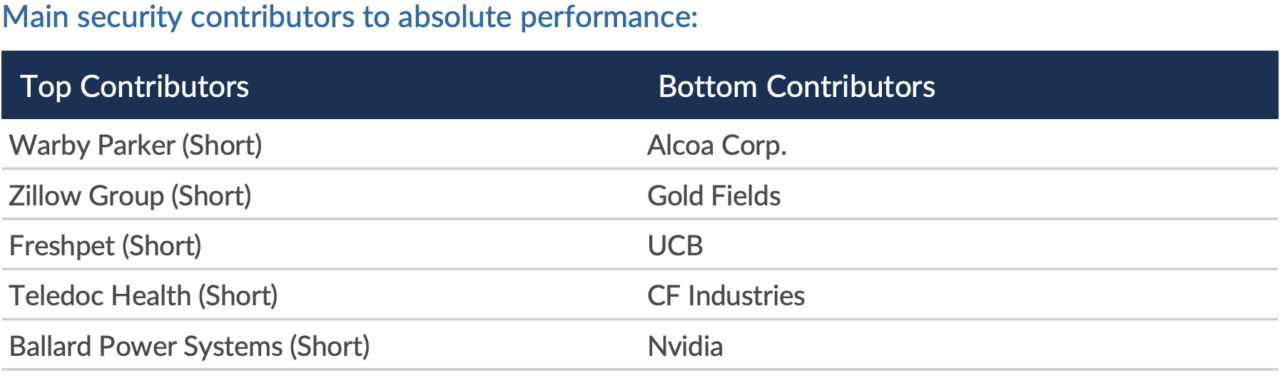

The Fund’s performance was dragged down in the second quarter by the freefall experienced by equity markets. Top contributors to absolute return were all Short positions, while Long positions fell.

To take advantage of the equity market downtrend, Shorts positions were maintained near their regulatory maximum of 50%, averaging 46% of Fund’s portfolio market value.

The Fund’s cyclical exposure was reduced in the quarter with weightings in the Energy and Materials resources sectors and the cyclical Financials sector all decreased. This was partially offset by purchases late in the quarter in the cyclical Industrials and Consumer Discretionary sectors, which were both net short. Conversely, the defensive and stable Consumer Staples and Health Care sectors were added to.

THE THREE-PILLAR APPROACH™

On the quantitative side, combining the Long and Short positions, the Fund’s portfolio has better parameters and factors exposure relative to the MSCI ACWI, with two exceptions. Profitability level is in line and revenue growth is lower.

The world equity market’s negative trend continued this quarter. Defensive factors such as dividends, value, and profitability outperformed the growth and volatility factors.

The fundamental background to world equities deteriorated further due to elevated inflation and rising interest rates. Slowing economies and lower expected corporate earnings point to poor outlooks in the short term and for 2022.