We last left you in early July with the observation that the financial markets now seemed to thrive on and reward uncertainty. The equity and credit markets had plunged in March on the initial economic fears over the Trump tariffs and then rebounded joyfully in April when Trump variously delayed and fiddled with his tariff strategy that had threatened to burn the U.S and global economy.

Bad News Bulls

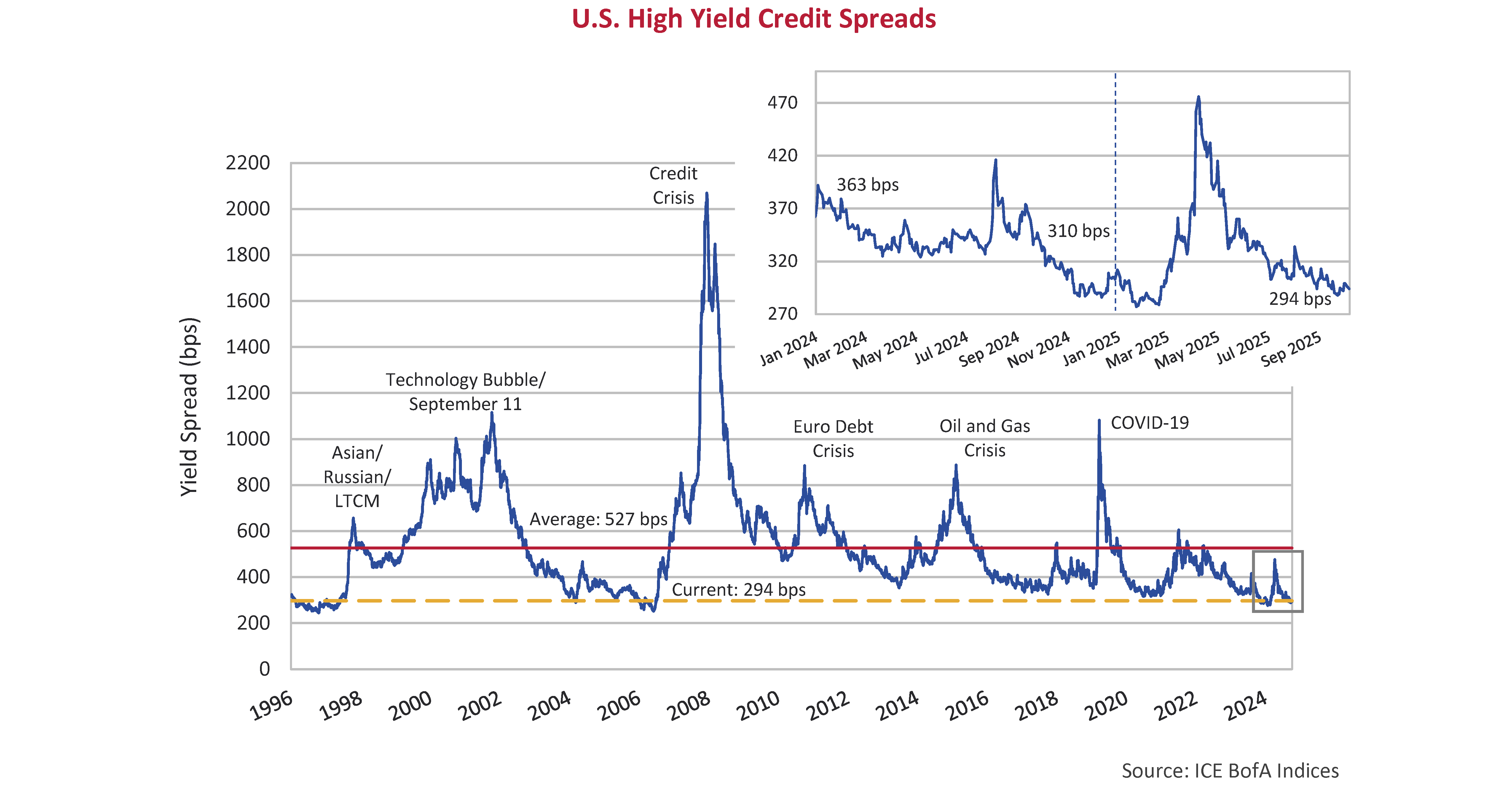

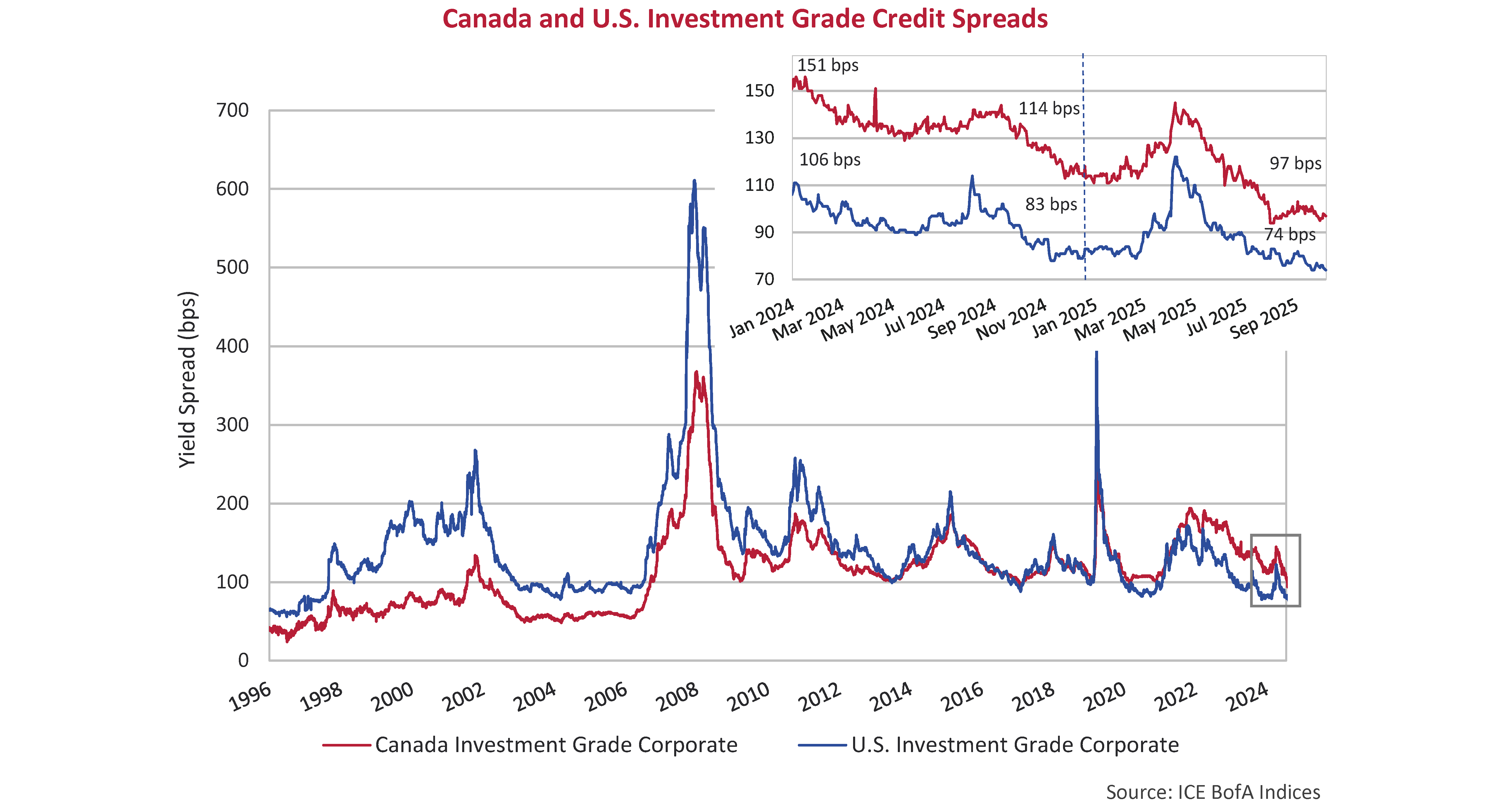

By the 3rd quarter of 2025, bad news was out of vogue. The financial markets were certainly ignoring any negatives in their surge to ever more expensive levels. Any new Trump tariffs were treated as noise to be filtered out by the financial markets, and it was back to business as usual for financial assets, getting more expensive. Stocks continued up and corporate bond credit spreads compressed ever lower to near record expensive levels, as the charts below show.

The S&P 500 returned 8.1% in the 3rd quarter, improving it to 14.8% year-to-date, a rally of 35.0% off the lows after the Trump Tariff tumble in early April. The tech and Magnificent Seven heavy NASDAQ index was up 11.4% in the quarter, improving to 17.9% year-to-date. Surprisingly, the standout performer was the formerly boring TSX index, up 12.3% in the quarter and 23.3% year-to-date. This defied the predicted dire effects of Trump’s trade war assault on Canada.

Trump Trumps TACO

The curious thing was, despite his TACO (Trump Always Chickens Out) label, Mr. Trump actually followed through and applied many tariffs at substantial levels after his July 9th deadline for his 90 promised deals that never happened. Despite new tariffs being applied to friend and foe alike, markets have ignored them for now. The base 10% Trump tariff level seems attractive compared to the ridiculous levels previously suggested, but it still changes intercountry terms of trade enormously. The 25% on autos and the steel and aluminum tariffs that were moved to 50%, even more so.

Psychologists and propagandists will tell you that if something is repeated enough, you tend to believe it, even though you know it to be false. Perhaps Trump’s repeated characterization of his tariff policy as “Beautiful” has rebranded it to investors as positive or at least not as negative as predicted by economic theory. It could also be that investors are drunk on the testosterone generated by their financial success, as Professor John Coates of Cambridge has shown in his research.

Immediate Market Answering Machine

We are not so sure that things are as rosy as the financial markets seem to believe. As we often tell you in these pages, there’s quite a difference between the short and long term in economics. Financial markets demand immediate answers and often come quickly to the wrong conclusions, that’s why they go up and down. The Trump tariff strategy is anything but normal. International trade and market efficiency were the watchwords of economists and financial professionals in the 80 years since WW2. Trump has turned the seemingly inexorable move towards international free trade and globalization on its head, making them the root cause of voters’ economic problems and not the solution to better a country’s citizens’ lives.

Tariff Postures versus Profits

U.S. businesses are currently avoiding Trump’s very public wrath by eating the tariff costs, but to maintain their profits they will eventually have to reprice their imported goods to reflect the tariffs they are paying to the U.S. government. Domestic competitors, that don’t even exist in some industries, will see there is insufficient supply and will raise their prices to have higher profits. It will be hard for Trump to criticize price hikes by domestic producers who will claim to provide for reinvestment in U.S. manufacturing.

It will take some time for even the first order trade effects to be felt domestically in the U.S., not to mention the second and third order effects. We think these will emerge and create some cost driven inflation. As we learned from the high inflation of the 1970s and the more recent pandemic inflation, if there’s enough money to pay higher prices, then prices will go up. There’s still a lot of pandemic cash in circulation and the Federal Reserve is under huge pressure to lower interest rates by providing more.

Too Much Cook in the Fed’s Kitchen?

It doesn’t help that Trump is publicly demanding interest rates be lowered by the Federal Reserve and is playing politics with the Fed Board by trying to fire Governor Lisa Cook, the first time a President has done this in modern history. It seems to us it is a matter of time before Trump wins his battle with the Fed for lower interest rates, even if the Supreme Court denies him on Cook. Trump will eventually replace Jerome Powell as Chair in 2026 when his term runs out, and Trump has stated he wants someone to lower interest rates.

This time around, Trump is choosing people for personal loyalty to him and not experience or acumen. The idea that the new Chair would not toe to the Trump demand on interest rates is as unlikely as the Justice Department and Federal Bureau of Investigation (FBI) dropping their investigation of Trump enemy James Comey. It would take politicians standing up for the Fed’s independence and courage among Republican politicians that is not common in Trump’s Washington. Witness the surrender of the former Deficit Hawks in the Freedom Caucus who rolled over on their no deficit increase beliefs in subservience and abject surrender on Trump’s One Big Beautiful Bill Act (OBBBA).

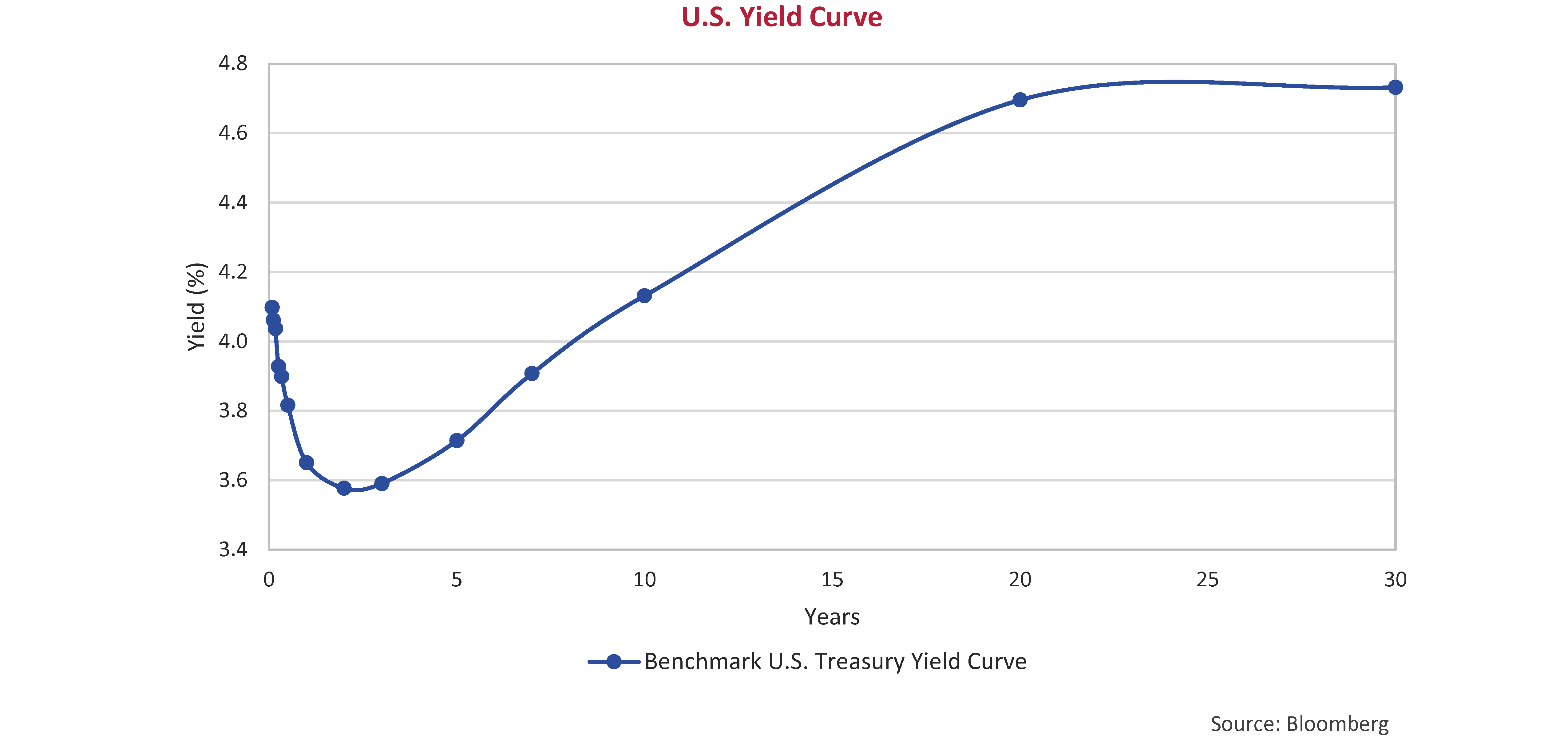

Bessenting the “King of Debt”

The OBBBA has lowered taxes and has lowered some expenditures, but most experts believe it will cause record U.S. deficits. Since U.S. deficits were already running at postwar record levels during the pandemic and under the Biden Administration, we are now at even higher levels. Trump, the self-styled “King of Debt”, believes he can finance his OBBBA deficits with tariff revenues but he won’t really mind issuing more Treasury Bonds if that’s what it takes to finance his priorities. Scott Bessent, the U.S. Treasury Secretary and former hedge fund manager, wants to finance short term. The vast amount of U.S. deficits that need to be financed suggest that, at some point, he will have no choice but to issue long bonds. All of this makes us believe that the U.S. will have a very steep yield curve with short rates held down by a Trump friendly Fed and long rates eventually reflecting tariff-driven inflation and substantial U.S. deficit financing needs. The current U.S. Yield Curve, shown below, will get even steeper as the Fed continues to ease.

Appeasement, Not Retaliation

The U.S. trading partners, except for China and Canada, have so far not retaliated with counter tariffs, and that has permitted Trump’s trade aggression to continue unhindered. Fighting an enemy that unilaterally surrenders, as most countries now have, makes the cost of fighting a trade war much lower for Trump. The Carney government in Canada has now moved from its “zero tariffs” and “fighting back” rhetoric during the recent election campaign to appeasement by removing trade “irritants” in the hopes of getting Trump to enter negotiations.

Tough Times Ahead for Canada

The Canadian government under Justin Trudeau applied counter tariffs against Trump’s initial round of tariffs and said they would use the proceeds to fund trade affected industries. Those tariffs are now gone as the Globe and Mail detailed:

“Then in August, Prime Minister Mark Carney said Canada would ditch its “elbows up” approach by scrapping tariffs on U.S. goods that comply with the United States-Mexico-Canada Agreement starting Sept. 1. In fact, an even wider swath of U.S. imports was granted exemptions than initially announced. ”1

The Carney government attempts to “remove irritants” didn’t help, as Trump has since added more tariffs on Canadian goods.

“Meanwhile, Mr. Trump has ramped up the tariff rate on Canadian imports. He increased fentanyl tariffs to 35 per cent on non-USMCA compliant imports, doubled the steel and aluminum tariff rate to 50 per cent and last week, targeted other industries like furniture and cabinet makers, pharmaceuticals and heavy truck manufacturers with new tariffs. ”1

The Globe and Mail estimated that the Trudeau counter tariffs collected were almost the same as the U.S. had levied on Canadian goods.

“By April, when Canada’s counter tariffs were in full effect, Ottawa collected an estimated $828-million in duties from U.S. imports, compared with $943-million (converted to Canadian dollars) collected by the U.S. on trade flowing the opposite way.”1

But those Canadian counter tariff revenues are now gone and can’t support affected Canadian industries. In our view, the Carney government has just unilaterally surrendered its trade weapons and is tapping out of the trade fight. Even though the trade minister responsible for negotiations with the U.S., Dominic Leblanc, claims that Canada still has some leverage, it is hard to see what:

“Dominic LeBlanc told the Senate foreign affairs committee Thursday that he believes Canada still has leverage in talks with the U.S., despite dropping retaliatory levies and scrapping the digital services tax that President Donald Trump opposed.

“Some challenges will remain for some time,” Mr. LeBlanc told the committee.

He was asked what power or influence Canada has in talks with the U.S. now that it has dropped countertariffs and the DST, which would have hit U.S. tech giants.

The minister said the U.S. is seeking Canada’s “enhanced co-operation” on some matters – which he declined to identify – but said the other matter in Ottawa’s favour is domestic U.S. pressure for relaxing tariffs on Canadian products. American companies that rely on steel, aluminum or autos from Canada will be bending the President’s ear.

“There are common interests – might be a more-gentle word – that we have with the Americans,” Mr. LeBlanc said. ”2

Some “challenges” will remain? That’s perhaps the understatement of the century by a Canadian politician. Well, we wish Mr. Leblanc well in his negotiations. “Common interests” are not something that a bully really respects or understands and certainly wouldn’t be called “leverage” in any normal negotiation.

If things don’t go well, it is implausible that the Carney government would put any tariffs back on, given how that would be viewed as a direct provocation by the Trump Administration, given the looming United States-Mexico-Canada Agreement (USMCA) renewal.

The problem is that Canada, as one of the largest markets for American exports, has just given up its substantial leverage. China, on the other hand, has made U.S. farmers suffer through its tariffs on soybeans that have priced them out of the Chinese market. The Trump Administration is now talking about using tariff revenue for a $10 billion bailout of soybean farmers and there will be more to come.

Trump Loves His Tariffs

President Trump held a press conference the day before PM Carney and team were travelling to Washington for a round of meetings with him. He exulted in the success of his tariff strategy:

“U.S. President Donald Trump defended his tariff policy and said it has been effective at persuading companies to leave Canada for the United States, a day ahead of a White House meeting with Prime Minister Mark Carney where the two leaders are expected to discuss trade.

Mr. Trump, speaking to reporters in the Oval Office on Monday, celebrated his protectionist levies as the actions of a successful president.

“Well, I guess he’s going to ask about tariffs, because a lot of companies from Canada are moving into the United States, you know, everybody’s moving back,” he said when asked what would be on the agenda for his Tuesday meeting with the Prime Minister. “They’re losing a lot of companies in Canada…”

When asked whether he would be open to changing his position on tariffs in his talks with Mr. Carney, Mr. Trump replied by talking up the amount of money the levies have raised for the U.S. Treasury.

“They find billions of dollars that they didn’t even know they had. Recently, they said they found billions of dollars and they couldn’t understand it. I said ‘check the tariffs shelf,’ and they come in the next hour and they say ‘sir, you’re right, it’s from the tariffs,’” Mr. Trump said.”3

The cash is rolling in and Trump is winning his trade war. He wants Canadian companies to move to the U.S., so why would he change his tariff strategy? Trump is a real estate developer and sees his tariffs as lease revenues. A cardinal rule of real estate is to never lower a client lease rate since that lowers the valuation of your property. That will make it very hard for the Carney government to get Trump to relent, absent buying a huge amount from the U.S. or funding part of Trump’s Golden Dome missile defence program.

A Munich Moment?

Like many Canadians, we have a sincere hope that the Carney government will be able to achieve its desperately sought after deal with Trump, but fear down deep that Trump will exploit what he sees as Canadian weakness. Perhaps PM Mark Carney will have his Munich Moment to announce “Trade Peace in Our Time”. That didn’t work out so well for another famous appeaser, Neville Chamberlain. We think that it is wishful thinking by Carney and his government to expect Trump to grant it trade clemency. Trump very much seems to think Canada is “not a real country” and, as a real estate guy, wants to develop us by making us the “Dear 51st State”. That’s not quite as bizarre as turning the Gaza Strip into a beach Condo development or invading Greenland, but we think Trump is serious about U.S. statehood for Canada. If he is, then harsher trade policy might just be used as the hammer to induce Canadians to join the U.S.

No Tariff Inflation

The only good recent news for Canadians is that the removal of the Canadian counter tariffs on U.S. imports will remove that source of potential inflation. Goods produced in the U.S. will not be tariffed by Canada but will have the U.S. import tariffs reflected in their prices. A beer or soup can or one holding a finished product imported by a Canadian company will still have the U.S. 50% aluminum or steel tariff reflected in their pricing.

The bad news is that the Canadian economy is suffering under the Trump tariffs on autos, steel, aluminum, the additional new duties on softwood lumber and the newer ones, including heavy trucks. Absent a return to free trade with the U.S., we expect that Canada could quite possibly enter recession.

Trade Overexposure

Years ago, when free trade was first proposed between Canada and the U.S. in 1988, some of us argued that if Canadian producers scaled to serve the U.S. market, then they would be highly exposed if the U.S. eventually backed out. That day is now here, despite no formal end to the Canada-United States-Mexico Agreement (CUSMA). Yes, if you apply Trump’s tariffs across all Canadian goods as the Carney government promotes, we are doing better than many countries.

On the other hand, the tariffs on autos, steel, aluminum, and lumber are very high for key Canadian industries and were imposed despite these goods being covered by CUSMA. We think that we Canadians are in for some very heavy economic weather ahead. Trump has stated that the U.S. doesn’t need anything that Canada manufactures and he is deadly serious about onshoring manufacturing. He has just reached into services with his proposed tariffs on television and film production that are also key Canadian industries.

Not At the Tariff Counter

In the old days before free trade, a country applied tariffs to imports and understood that the same would apply to its goods in foreign markets. The problem now for Canada is that we represent 10% of the combined U.S. Canadian market and we’ve given up production of many domestic goods. Rebuilding that manufacturing capacity without tariff walls to protect it would be reckless. The modern international trading system allows an exporting country to countertariff foreign goods if that foreign country has tariffed the damaged country. The exception is “national security” so that’s why many countries are now waving that banner, as Trump has done in the U.S. and the Carney government is now doing.

Canada has now just given up all its tariffs on goods inbound from the U.S. so it is difficult to see how building up Canadian manufacturing will work as the Carney government proposes. Canada is just 10% of an American company’s production, so the economies of scale and cost dynamics are very much with potential U.S. competitors who now face no tariffs on their exports to Canada. A return to “managed trade” would mean tariffs on both Canadian and American imports so it’s going to be some time before we have visibility into how that would work.

No Housing or Immigration Boom

The go-to Canadian economic solution for recession is to stoke the fires of the Canadian housing market. That worked after the Credit Crisis but will be unlikely with the post-pandemic Canadian real estate mania finally sputtering to a close with listings soaring and sales at record lows. After the Zero Interest Rate Period (ZIRP) from 2011 to 2021, the pandemic real estate mania and with interest rates at more normal levels, we don’t believe there’s the capacity or consumer belief to create another real estate boom. The roll back of the insane Trudeau government temporary immigration surge is good policy and politics so increasing demand by stoking the immigration fires is also unlikely.

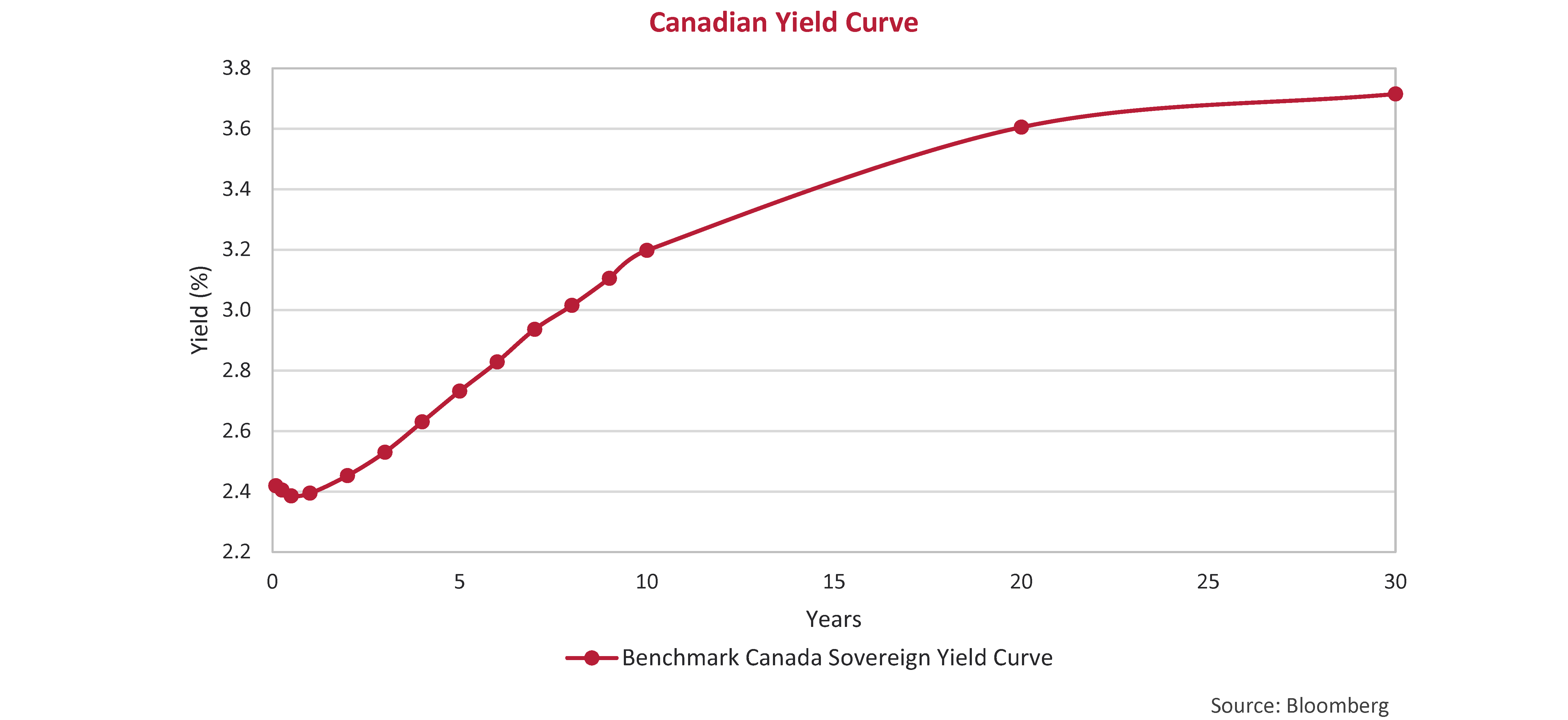

It will be an expensive business to finance support for those affected industries without the funds from the Trudeau countertariffs. We expect the Bank of Canada to ease alongside the Federal Reserve, since the last thing the Canadian economy needs is a stronger Canadian dollar. As we’ve said earlier, we think the long end of the U.S. bond market will likely hold higher with tariff inflation and a very steep yield curve due to the huge U.S. deficits ahead. The long end of the Canadian bond market will likely hold higher in sympathy with the U.S. Treasury market, as well as increased Federal and Provincial government deficits. That will make for an even steeper Canadian yield curve than the present steep one below.

Our Hazy Crystal Ball

In terms of our crystal ball, things are just as hazy as they were last quarter. It is too soon to see the effects of Trump’s “Trade War on the World”. The first order effects of the tariffs are self-evident when the tariffs are paid on goods imported to the U.S. The second and third order effects are still to come, as trade patterns shift. Exports and production priced out of the U.S. market by Trump’s tariffs are looking for other markets and anywhere but the U.S. seems vulnerable. Canada has already seen tariffs from China on Canadian canola exports, due to Canadian “Dumping” (selling below cost) tariffs on Chinese steel and other goods. Canada is in a particularly bad position, as a small market now heavily dependent on exports to the U.S. after years of free trade.

Our Current Strategy

The investment markets seem to just defy gravity and continue their upwards strength. Any negatives are glossed over and positives stoke further enthusiasm.

It takes considerable courage as a trader or portfolio manager to step back from these hot markets, risking being left behind and possible career peril, but that’s what we’re doing.

Indexing and quantitative/Artificial Intelligence (AI) trading strategies are simply trend following strategies, despite their grand names. What goes up, goes up more, attracts more investment flows and keeps going up.

Until it doesn’t.

Footnotes:

- Source: Kirby, Jason. (2025, October 4). U.S. tariff revenue piles up as Canada abandons tit-for-tat trade war approach.

- Source: Chase, Steven. (2025, October 2). LeBlanc hopes to make progress on steel, aluminum tariff relief before USMCA review

- Source: Chase, Steven et al. (2025, October 7). Ahead of talks with Carney, Trump says his tariffs are working.