Last year was a volatile one for the financial markets as unpredictable Donald Trump entered the White House in January. Expecting the returning President Trump to bring hot markets with his election, as in his first term, investors soon learned to their chagrin that he was serious about his “Beautiful Tariffs”. Markets then tanked, recovered and then soared when he dropped the worst of his tariffs. That, and a renewed Artificial Intelligence (AI) mania, ignited a buying frenzy. Seemingly everything that could be traded went up, with even crypto, gold and silver joining the financial market glee.

Liberated Markets

Financial market returns for 2025 were great. The Nasdaq was up 21.1%, the S&P was up 17.9% and even the staid and stodgy old economy Dow Jones was up 14.9%. Those perfidious foreigners did better with the Toronto Stock Exchange up 32.1% on gold, banks, and resources, and the EAFE index up a tad less at 31.2%. The only thing that didn’t seem to go up was the U.S. dollar, as it was down 9% for 2025 against a basket of major currencies. Certainly, Trump’s Liberation Day was not terrible for the stock markets of the foreign countries he targeted with his tariffs, a rather “un-reciprocal” outcome not foreseen by investors.

There were no crypto pardons for the investors who piled into it because of Trump family cheerleading. Despite being shamelessly promoted by the Trump Administration and his family, Bitcoin ended down 10.6% for the year. It had rallied hard early in the year on Trump’s support but got slammed during the tariff markets and rallied once again before being sold off hard at year end. That was a bit of a wild ride to those promoting crypto as a monetary store of value, immune from inflation and governments. It was also probably a shock to them that gold, that old monetary standby, was up 64.6%.

Trumping the Federal Reserve

The long end of global government bond markets eyed things suspiciously, due to governments turning to deficit financing globally. It was long-term bonds that underperformed, with Long Treasuries up only 5.6% compared to Mid Treasuries at 8.0%, as mid-term bond yields dropped much more than their long-term cousins. Canadian long bonds sold off at -4.6% compared to mid-Canadas being up 3.2%, perhaps reacting to Federal and Provincial government bond issuance to support those industries affected by Trump’s tariff attack on Canada.

Spend, Delay, and Suspend

The U.S. economy was reasonable, as the effects of the Trump tariffs were delayed and suspended, so their real impact will take time to discern. The U.S. Federal Reserve’s eased policy sent U.S short-term yields down, but the bond market was not loving Trump’s threat to the independence of the Federal Reserve or his propensity to fund his many promises by borrowing money. Trump even bullied the Freedom Caucus into voting for his Big Beautiful Bill Act (BBBA). The threat of Trump’s displeasure and being “Primaried” carried the day and made a mockery of the Freedom Caucus’ traditional objections to government deficit financing. And deficit financing there is, according to a recent Editorial by the Washington Post in support of a bipartisan bill:

“A bipartisan group of House members are rallying behind a welcome and reasonable (3%) target for 2030. The federal budget deficit was roughly 6 percent of gross domestic product for each of the past three fiscal years. During a three-year span of low unemployment, economic expansion, increasing revenue and no major foreign wars, the budget deficit was larger as a share of the economy than any year of the 1930s, the decade of the Great Depression.”1

Other developed countries are also running up deficits as health care and defence concerns increase spending. Canada is at the forefront of increased spending, as the “new” Carney Liberals have blown through the old Trudeau Liberal budget that caused then Finance Minister Freeland to resign. Support to tariffed industries and needed Canadian military spending are worthy causes but it still means spending financed by government bond issuance.

Trump’s attacks on Fed Chair Jerome Powell and threats to fire him and Governor Lisa Cook didn’t help. To make things worse, the not so independent Trump Justice Department has just initiated a possibly criminal investigation into the Fed and Powell over purported “fraud” for cost overruns in their recent renovations. Clearly, Trump’s priorities for the next Chair of the Fed are not monetary independence but personal loyalty to him and a firm commitment to lower interest rates:

“I’ll soon announce our next chairman of the Federal Reserve, someone who believes in lower interest rates, by a lot, and mortgage payments will be coming down even further,”2

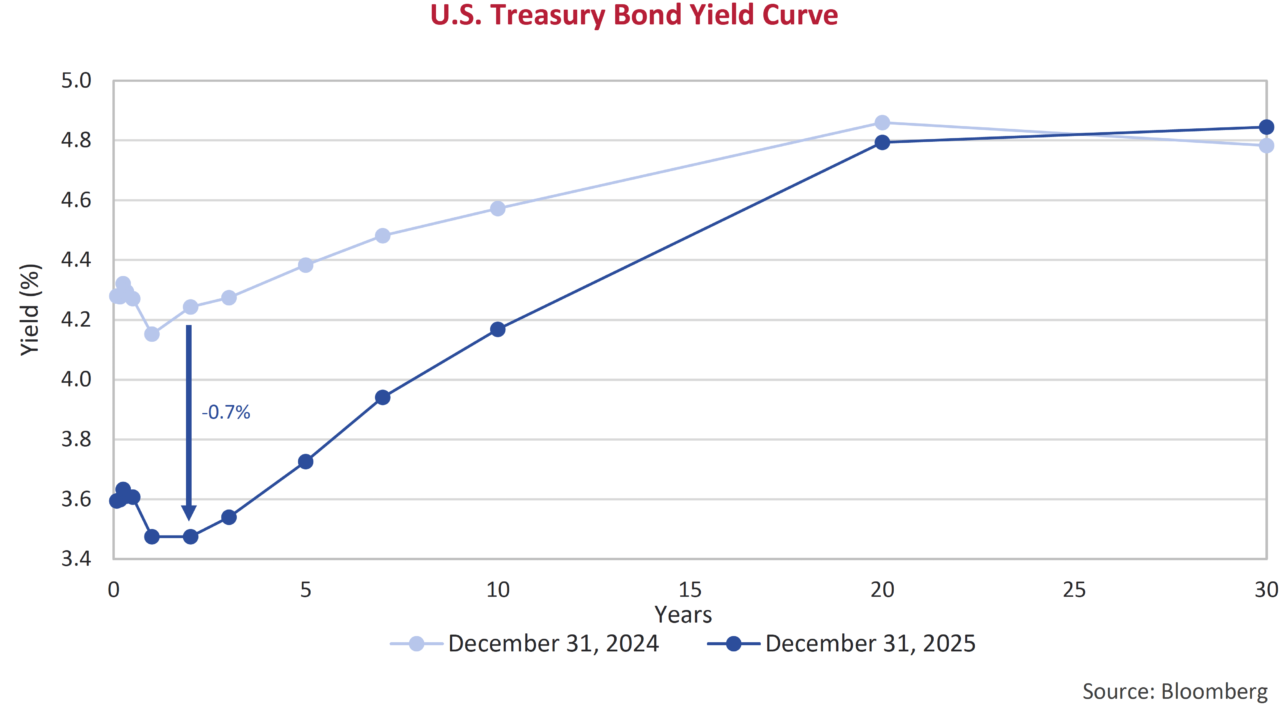

So, it seems that lower short-term interest rates are on the horizon after a new Fed Chair takes over from Jerome Powell when his term ends this May. Monetary accommodation, fiscal stimulus and higher inflation are indeed what the U.S. bond market seems to be forecasting with its current steep yield curve. As seen in the chart below, 30-year Treasury yields are up a little in the past year while the 2-year is down 0.7%.

Canada’s Yield Curveball

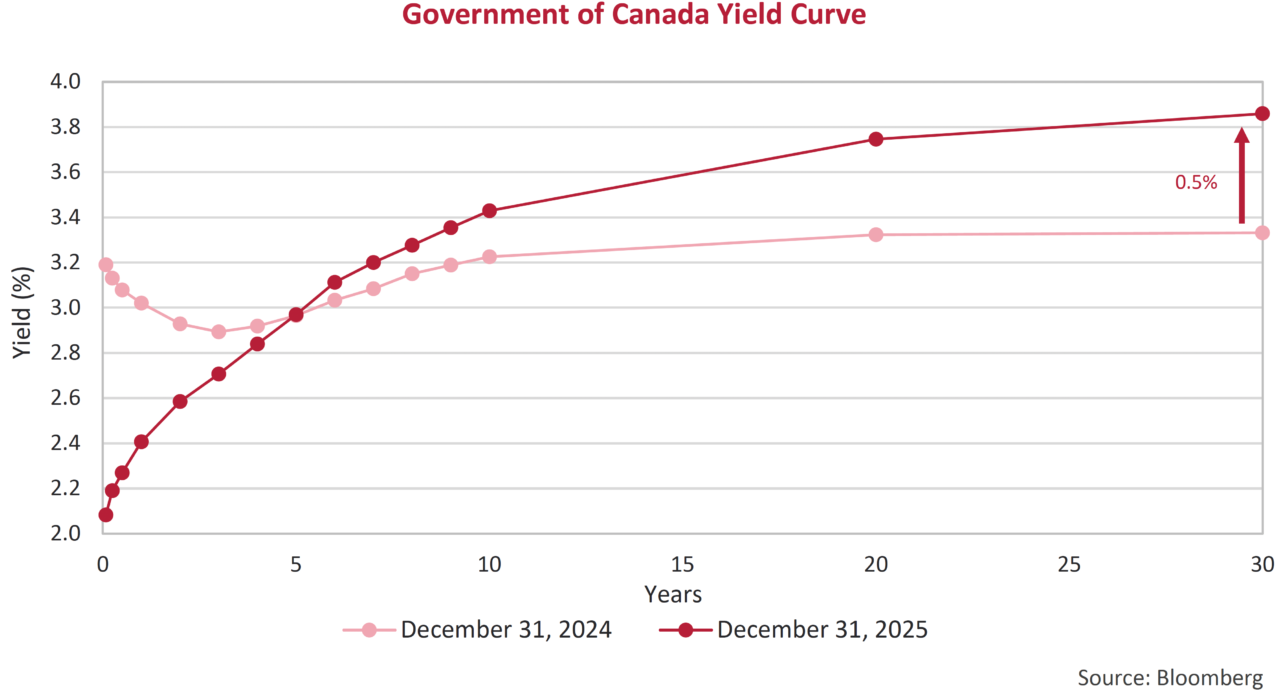

It was a very different picture in Canada, with the Bank of Canada, which led the Fed and other central banks on the way down for interest rates, holding its rate at 2.25%. Where the U.S. bond yields are lower across the term structure, Canadian yields are actually up versus last year from the 5-year to the 30-year Canada bond as the chart below shows. That suggests to us that investors are expecting substantial issuance of Federal and Provincial government bonds to subsidize industries affected by the Trump tariffs.

Giving Credit to Bond Managers

After their funds had very negative returns when yields spiked in 2022, active bond managers were in no mood to stray far from their indices on term and duration. That meant the additional yield from overweighting corporate bonds was the only way for them to “outperform” their benchmarks. The corporate bond and credit markets celebrated that they were the only game in town and credit spreads yanked tighter. Lower quality credit did the best, with the ICE BofA U.S. High Yield Index up 8.5% and the bank loan Morningstar LSTA U.S. Leveraged Loan Index 5.9%. In the reverse of the equity markets, the U.S bond market outperformed the Canadian bond market, due to U.S. bond yields falling while Canadian yields largely rose. The ICE BofA U.S. Broad Index was up 6.8% compared to the FTSE Canada Universe Bond Index at 2.2%. The ICE BofA U.S. Corporate Index was up 7.8%, compared to the 4.5% of the FTSE Canada All Corporate Bond Index.

As bond index ETFs gained retail income investing market share, “portfolio trades” of underlying bond baskets added to the frenzy for corporate bonds. Corporate yield spreads are very tight as a result, and we don’t think the current corporate spreads offer great value on lower quality issues.

InCreditulous

Anything with a “promised” yield superior to government bonds is now loosely defined as “Credit”. That could be the misnomer of our investing times, as the word credit comes from the Latin “credere” or belief, faith and trust which means that the lender has the belief and trust that the borrower will pay her back. Given the continuing mania in private credit and current market innovation in Liability Management Exercises (LMEs), otherwise known as stiffing your creditors, this new age of credit involves a blind faith that nothing can go wrong, given the tightness of credit spreads.

Don’t Bank on CLOs

Bank loans and high yield are in vogue once again, as Collateralized Loan Obligations (CLOs) buy them to securitize to create even more “yield”. That’s identical to what happened with Collateralized Debt Obligations (CDOs) based on subprime mortgages before the Credit Crisis. As we said at that time, if you bundle manure into packages, it’s still manure. ETFs based on numerous AAA tranches of CLOs rely on the statistical artifice that the underlying low quality bank loans and bonds will perform as expected, the subordination will protect you and the losses won’t be greater than your assumptions. Dealing directly in bank loans ourselves, we know they are illiquid and the private equity sponsors behind many of them don’t necessarily believe in repaying their loans if it’s to their disadvantage. That’s why many are restructured through LMEs on terms injurious to their lenders.

Stupid-End-Us

The Hedge Fund industry is moving to a “Multi-Strategy” model where teams of traders use leveraged capital to independently “manage” portfolios. The idea is that these smart and sharp investors will in aggregate deliver high returns with diversification. In reality, this recreates the proprietary trading shops at bank investment dealers in the lead up to the Credit Crisis who blew up stupendously at the end of that market bubble. Today’s Multi-Strat equivalents also employ substantial cheap and leveraged capital through their Prime Brokers, who reportedly require very little to no margin protection from the biggest funds.

What could possibly go wrong? Every market bubble and sell-off is driven by leverage and this one is no different. These funds have all piled into the same trades and the market winners. In our bailiwick of corporate bonds, the narrowing yield spreads on corporate bonds meant that hedging corporate bonds has been very profitable. Amplifying the profits through leverage has also proved irresistible for the hedge fund crowd. When the tide goes out and margin calls are made, things will get ugly. Forced selling into a terrified market never works out well.

The Trade War that Wasn’t

The predictions of a trade war and tariff induced Recession haven’t come true and economists are struggling to understand what happened. Economic convention held that tariffs and trade wars were destructive to all countries concerned, creating barriers and lowering international trade. That was what happened when the Smoot Hawley Tariffs by the U.S. set off a trade war in the 1930s. The difference here is that most countries, under demand and threat from President Trump, didn’t respond in kind to the U.S. tariffs, avoiding a dire trade war.

U.S. inflation did better than expected, although staying higher than the Fed’s 2% target at 2.7% year-over-year for all items and 2.6% excluding Food and energy in December 2025. That’s surprising, given the average U.S. tariff rate at 10.7% in September, as calculated by Penn Wharton Budget Model. Companies, anticipating the tariffs, stocked up at the lower prices before the tariffs were implemented, but those are now running out. It also helped that the Trump Administration unilaterally delayed and/or lowered many of his announced high tariffs significantly or entirely, fearing consumer backlash. Trump announced bilateral “deals” with many countries that lowered his worst tariffs with details to follow. The very high tariffs on electronics and mobile devices were suspended almost immediately after Liberation Day in April as Apple and other companies explained the potential huge price increases on popular mobile devices to Mr. Trump. More recently, the Trump Administration delayed duties on 200 imported food items, including Italian pasta, and consumer items like upholstered furniture, kitchen cabinets and vanities. The stated reason was ongoing negotiations with other countries, but the reality was the political pressure on affordability that showed Trump at personal lows in polls, even on the economy that used to be his strength.

Who’s Paying the Tariff Cost?

Economists are now trying to discern the real effects of tariffs. The New York Times wrote a good article on the first studies on the effects of the Trump tariffs that showed it was American consumers and companies that were paying for 94% of tariffs:

“The researchers demonstrated that Americans were bearing the cost of Mr. Trump’s tariffs, in contrast to what he and his advisers have claimed…

…The foreign factories that export products to the United States could absorb the cost if they reduce the prices they charge to American buyers to offset the tariff.

This is what the Trump administration argued would happen. But Ms. Gopinath and her co-author, Brent Neiman of the University of Chicago, calculated that U.S. importers, not foreign suppliers, were bearing the bulk of the cost. They estimated that 94 percent of tariff costs were “passed through” to U.S. firms in 2025. That compared with about 80 percent in 2018-19, when Mr. Trump imposed many tariffs on China…

…U.S. consumers and manufacturers are also paying higher costs. A working paper published in November by economists at Harvard Business School and elsewhere found that tariffs had pushed up the price of imported goods by roughly twice as much as domestic ones.

“The logic was if foreign firms wished to sell to the mightiest consumer market in the world, they would have to pay a price,” Ms. Gopinath said. “In reality, the price has been borne by U.S. firms, and not by foreign firms.””3

Fine for Now

Contrary to expectations on the Trump tariffs, the economies in the U.S. and many other countries seem to be doing just fine for now, at least from their reported GDP nominal economic growth. It’s hard to know for sure in the U.S., since the government shutdown over the summer stopped some data collection activities by the Bureau of Labour Statistics (BLS). Taking the published BLS numbers at face value, the predicted tariff-induced recession didn’t happen. In the U.S., the massive investment into AI by the Tech giants has kept things hopping as the demand for data center construction soars. The other very positive thing was the soaring financial markets and asset price appreciation. There is much discussion about the “K shaped” economy where the wealthy are getting even wealthier and their share of spending is holding things up. Clearly, if your livelihood comes from the financial markets, your fees and commissions have jumped with the rising markets, but many other people have benefitted from the stock market rally to new highs after the Liberation Day tariff selloff.

Equity Induced Happiness

According to the Federal Reserve’s Survey of Consumer Finances4, a record 58% of Americans owned stocks in 2023, but that is very concentrated among the wealthiest. The top 10% of Americans by wealth now own 93% of U.S. equities but the bottom 50% own only 1%. The President is wealthy, and his businesses also cater to his wealthy peers as clients. He knows from personal experience that people spend a lot more money when their investments are doing well. The reason that President Trump backed off on the worst of his tariffs was the selloff in the stock market, one of his favourite gauges of a strong economy. He is still watching it closely and wants a strong stock market as his comments on his preference for a new Fed Chair suggest:

“I want my new Fed Chairman to lower Interest Rates if the Market is doing well, not destroy the Market for no reason whatsoever. Anybody that disagrees with me will never be the Fed Chairman!”

That’s a pretty clear message on what’s important to Trump and what he wants the Fed to do.

Let Them Eat Stocks and Crypto!

It is salient to note that a “good” economy statistically just means rising real (nominal minus CPI) growth in aggregate. That doesn’t consider how actual people are doing and perceive the economy. That bottom 50% who own 1% of stocks and/or don’t have houses are the downwards leg of the so-called K shaped recovery. Combining them with the top leg of the K gets us to the overall GDP and income numbers. Polls and surveys show those bottom K voters are not impressed with their share of the spoils at present. The Washington Post asked their readers for comments about tariffs in the For You section:

“Several of you expressed concerns over rising prices and difficulties for small businesses… …Many of you were particularly concerned about the increase in costs of groceries, noting increased prices in imported goods that can’t be natively produced. “I can’t afford food now and everyone is suffering except the wealthy,” Elizabeth Trice wrote. “How are we supposed to live like this?””5

The Trump Administration is currently under political pressure over the still high cost of living. After making unachievable promises to get prices back to pre-pandemic levels, Mr. Trump is now telling Americans that rising prices and affordability are a Democrat Hoax. Being from the wealthy 10%, he points to the strength of the stock and financial markets as the real indicator of his economic success. The problem is that Americans without stock portfolios and appreciated houses are struggling, as the comments above suggest. Trump echoes Marie Antoinette when he claims the roaring stock market means things are great economically. “Let them eat stocks and crypto” is not really what economically challenged voters want to hear.

Election Hype Meets Trump Reality

Despite the Trump tariff attack, Canada has so far avoided economic doom as well. Yes, as the Carney government loudly declares, Canada has lower average tariffs than other countries due to the significant goods exports covered by the United States-Mexico-Canada Agreement (USMCA) free trade agreement. However, the punitive U.S. tariffs on the important Steel, Aluminum and Lumber industries are still in effect. Carney and his trade team are now lowering expectations of immediate tariff relief on them, hopefully to get a better result with the re-negotiation of the USMCA. We hope so, but when Donald Trump has an opponent on the ropes, he goes for the knockout blow. His clear preference is for having maximum negotiating power through bilateral deals, especially with weaker parties who have more to lose, so it’s not certain to us that USMCA will be extended.

The problem for the Carney team, as we see it, is that they think Trump will be drawn rationally into negotiating a “Win-Win” deal. Trump’s recent moves in Venezuela should give Carney and his trade team pause. That was in defiance of international and American convention and laws, with the additional message that he now “owns” Venezuela’s oil and will “run” that country.

We don’t know how Trump’s Venezuela strategy will work out, but it suggests to us that Carney should not assume that Trump wants a fair deal or will see mutual benefits to free trade. Trump is all about winning and shaming his dreaded “losers”. He has stated repeatedly that Canada produces nothing the U.S. needs and is not a “real country”.

A World of Manufacturing Hurt

Unfortunately, Carney went from “Elbows Up” during the election to dropping all of the Trudeau tariffs that were designed to maximize the hurt to Republican U.S. politicians. Carney also surrendered to Trump on the Digital Sales Tax. That means that Canada has few tariffs on inbound U.S. goods and that certainly won’t foster a “reindustrialization” of Canada. It is normally hard for Canadian companies to compete with their larger U.S. competitors in the U.S. market, but it is literally impossible if there are high tariffs on Canadian goods entering the U.S. As we’ve said, many Canadian goods are covered by the USMCA exemption that the U.S. is honouring, but Aluminum, Steel, Autos and Forestry products are still being slammed with very high U.S. tariffs.

A Globe and Mail article featured the huge difficulties that Canadian manufacturers are facing. The struggles of a snowplow manufacturer from London Ontario, Arctic Snowplows, illustrate the issues with PM Carney’s dropping our tariff weapons:

“When Arctic Snowplows ships a $10,000 plow to the U.S., it now comes with an added cost of $500.

That’s because the London, Ont.-based company, which makes heavy-duty plows for snow clearance, is getting hit with a 50-per-cent duty on the steel content in its finished product. Jim Estill, owner of the nearly six-decade-old company, said U.S. sales are down 40 per cent as a result of Mr. Trump’s protectionist policies…

…A year ago, Mr. Estill was unequivocal that Canadian policy makers needed to retaliate against U.S. tariffs. That’s not exactly how things have panned out. Prime Minister Mark Carney has rolled back many of Canada’s countertariffs on the U.S. in a bid to revive trade talks, including charges on American snowplows.

As a result, Arctic Snowplows faces tariffs when selling to American customers, but its U.S. competitors face no such duties when selling into Canada.”6

You Got to Know When to Hold

As the song goes, “You got to know when to hold, …know when to fold”. Team Carney’s decision to fold and drop Trudeau’s tariffs to assuage President Trump was made to smooth the way for a quick deal that didn’t happen. We are now told by PM Carney that there won’t be one in the near term since the focus is now on the renewal of the USMCA. A key strategy for labour negotiations is to delay until the pressure to settle gets too high for your opponent. Our fear is that will be exactly Trump’s strategy against Canada for the re-negotiation of USMCA. Canadian manufacturers could be waiting a very long time for tariff relief into the U.S. while their American competitors have tariff free access to Canada. Carney now won’t be able to reinstitute tariffs. If Carney feared Trump’s wrath on Trudeau’s tariffs, a Venezuela supercharged Trump must terrify him. Carney set very high expectations of his negotiating skills during his election campaign so he will be under immense pressure to settle.

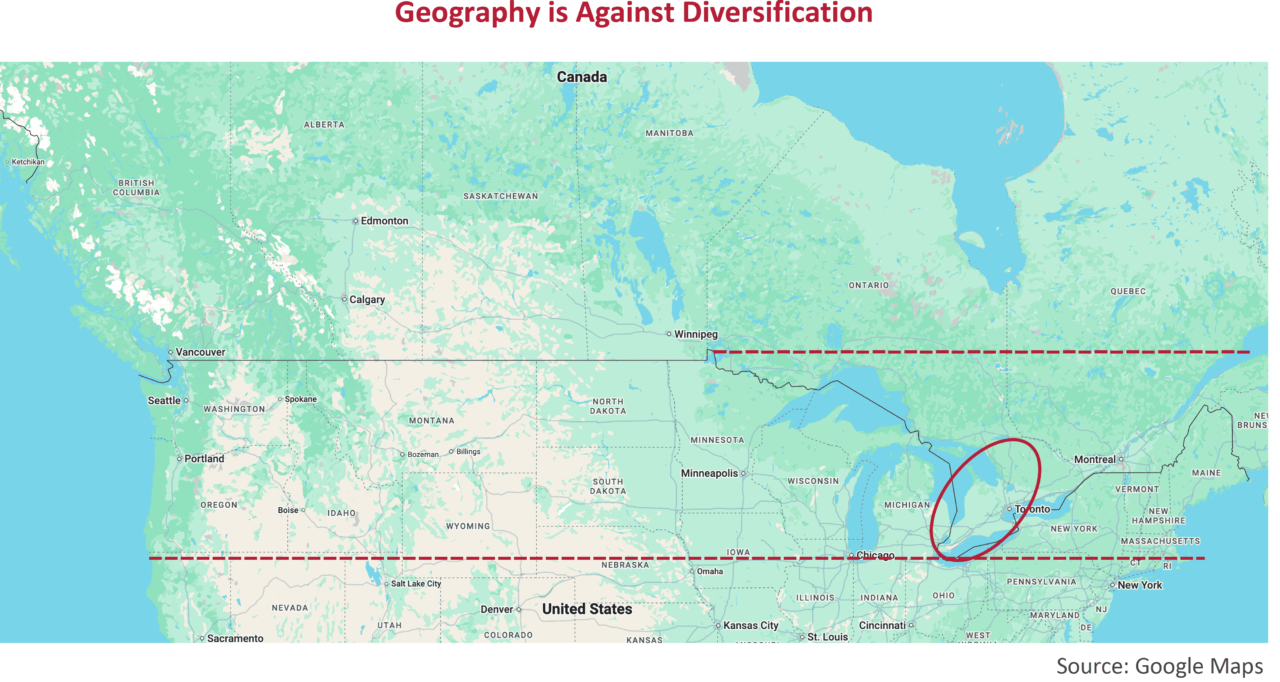

Geography is Against Diversification

While waiting for his elusive deal with Trump, the Carney government strategy is to diversify Canada’s trade into other markets and increase trade between the Canadian provinces. The problem with this approach is geography and logistics, as inspection of the map below shows. While the 49th Parallel is the border between the U.S. and Western Canada, Southern Ontario sits at 43° to 44ۜ° North Latitude, south of much of the U.S. Pelee Island in Lake Erie, the southernmost place in Canada, is at the same latitude as Northern California. Windsor is south of Minnesota, Wisconsin, and most of Maine, Vermont, Massachusetts, Michigan, Oregon, Washington and New York states.

That’s what makes it very central logistically to much of the U.S. population and very attractive a location for Canadian and foreign businesses to supply that large market. Clearly, shipping goods to overseas markets from Southern Ontario by rail and sea is not as easy as trucking just over the border to the U.S. That is why Ontario Premier Doug Ford is so hawkish on trade policy with the U.S. This logistical reality is what makes international trade diversification so difficult. Trump called his tariffs “Reciprocal”, but “Reciprocity” was the bilateral free trade agreement between British North America, now Canada, and the U.S. from 1854 until the U.S. cancelled it in 1866. Sound familiar??

It’s Always Been About U.S. Competition

One of the reasons that Canada was founded in 1867, after the end of Reciprocity, was to encourage trade between the former colonies of British North America. This increase in inter-Canadian trade was called the National Policy. As the Canadian Encyclopedia explains:

“The National Policy was a central economic and political strategy of the Conservative Party under Prime Minister John A. Macdonald, and many of his successors in high office. It meant that from 1878 until the Second World War, Canada levied high tariffs on foreign imported goods, to shield Canadian manufacturers from American competition.”7

Since Canada represents only 10% of potential sales for a much larger American company, Canadian companies are likely to be overwhelmed by the scale and cost advantage of their American competitors in the Canadian market. Successive Canadian governments saw manufacturing as the key to nationhood, along with the cross-Canada railroads. Domestic Canadian manufacturers were supported by high tariff barriers. American companies like Ford Motor, General Motors and Nabisco that wanted to sell into the Canadian market had to establish Canadian operations to avoid Canadian tariffs. This led to “Branch Plant” domestic production of many goods in Canada. Those have all but disappeared with free trade with the U.S.

A Reverse National Policy??

Despite the protections of the USMCA, by dropping Trudeau’s tariffs in the hopes of striking a deal, Mr. Carney has accomplished the opposite of the National Policy. He’s shielded U.S. manufacturers from Canadian tariffs while having tariffs on the many Canadian manufactured goods that use aluminum and/or steel that attract 50% U.S. tariffs. As the Globe and Mail also reported, things are getting desperate for Canadian manufacturers:

“Canada’s manufacturing sector contracted for an 11th straight month in December as trade uncertainty contributed to a steeper decline in output and new orders, data showed on Friday… “Once again, tariffs remained an important theme amongst PMI survey respondents, with a general air of uncertainty continuing to negatively weigh on current and expected output levels for the year ahead.””8

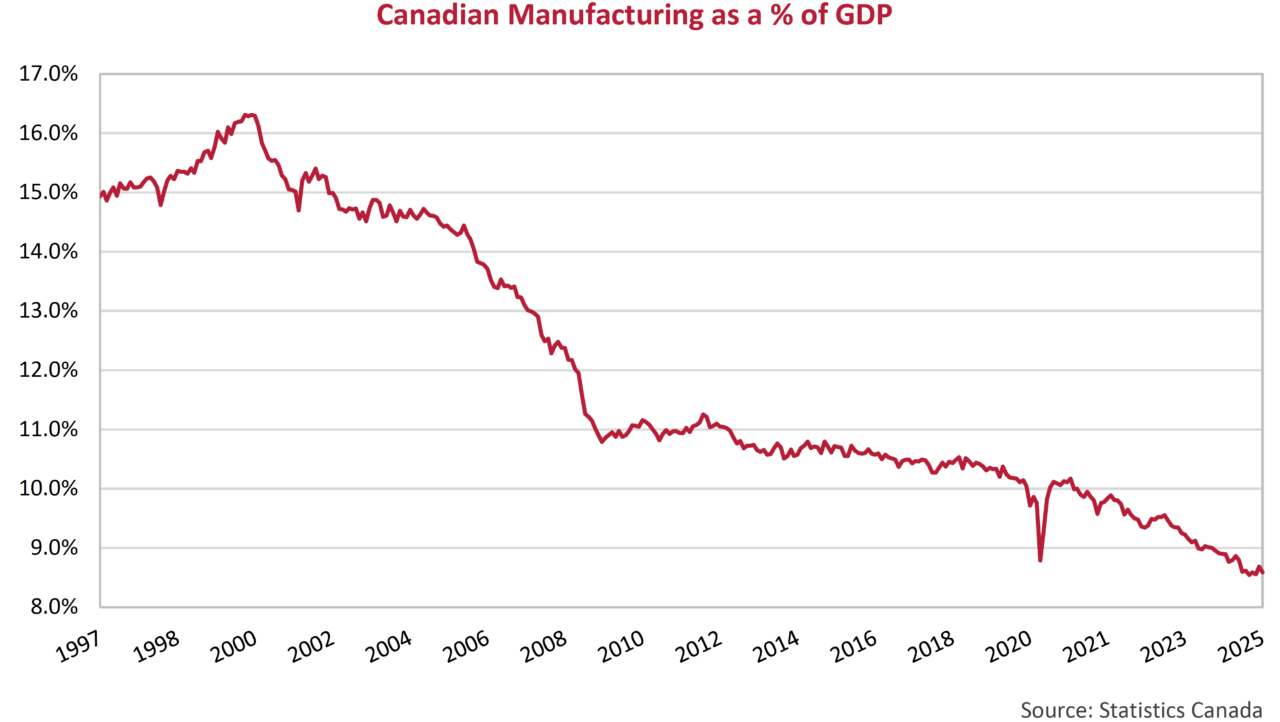

The lack of tariffs on U.S. competitors pretty well sounds the death knell for Canadian manufacturers, largely concentrated in Southern Ontario, if this keeps up. Free and global trade have not been kind in any event, as the chart below shows. Initially the North Agreement Free Trade Agreement (NAFTA) saw increased manufacturing in Canada peaking at 16% of GDP in 2002. Then it dropped to 14% by 2006 and plunged to 10% as Mexico’s lower costs lured manufacturers and global free trade, particularly with China, savaged domestic production. The current U.S. tariffs have dropped it towards 8%, half of what it was in 2002.

Our smaller manufacturers have been taken over by international companies with their domestic Canadian manufacturing moved abroad. Iconic Canadian brands like Bicks Pickles and E.D. Smith jams are now made in the U.S. We can’t reindustrialize Canada without protecting our companies and essential industries. It is not chance that our largest and most successful Canadian businesses are protected by regulation: banks, airlines, insurance companies, communication providers, utilities and pipelines.

Donnie’s Doctrine

The leverage that President Trump is going to have in the renegotiation of the USMCA will be very high and the Americans know that. We’re hurting more than the U.S., due to our unilateral surrender on tariffs. Trump’s other trade deals have placed tariffs on foreign goods entering the U.S. but the other countries have not placed retaliatory tariffs on U.S. goods to avoid a trade war. Their base tariff level at 10-15% is not promising. If Canadian goods are tariffed into the U.S. with the renegotiation of the USMCA but U.S. goods are not tariffed into Canada, then things will continue to be dire for Canadian manufacturers.

The so-called “Donroe Doctrine”, an update of the 19th century Monroe Doctrine, is all about U.S. supremacy in the Americas and restoring mercantilism where manufacturing occurs in the U.S. and resources come from Venezuela and other client states. Is Canada destined to be one of them? Trump’s comments about Canada now take a different tone given his recent actions in Venezuela and intent to “own” Greenland. As a triumphal Trump said in his news conference after capturing Maduro:

“The future will be determined by the ability to protect commerce and territory and resources that are core to national security… These are the iron laws that have always determined global power, and we’re going to keep it that way.”9

As PM Carney says, “things have changed” but he and his cabinet aren’t acting like that.

Multilateralist or Iron Laws?

Carney and his most trusted colleagues are internationalists who built their careers and reputations networking at Davos and in the halls of international companies and conferences. They now present as Canadian nationalists but down deep they probably believe in multilateral organizations, treaties and negotiations for the greater global good. Are they suited for Trump’s bilateral world where naked self-interest dominates? It is in the U.S. interest to drag out the USMCA review and renegotiations. Given the power disadvantage and Trump’s supremacist approach to international relations, Canada should not expect a quick or even a reasonable outcome.

Diversifying Canadian trade by striking free trade agreements with far larger and lower cost countries will just further pressure Canadian industries other than resources, housing and our protected regulated industries. The current plan seems to be to once again juice the Canadian housing market, financially support the tariff affected industries, and have additional fiscal stimulus by government spending on defence. All of those mean much more government spending and bond issuance.

Time for a New National Policy??

We’ll see what happens with the USMCA renegotiations, but if Canada is to survive perhaps it’s time for a new National Policy if Canada is to remain an independent nation. As Trump says about the U.S., we Canadians have almost everything we need in Canada. Under free trade, we have scaled our successful manufacturing to meet the U.S. market and given up on smaller manufacturers. Studies supporting the benefits of free trade in the 1980s showed a 1-3% increase in GDP. Is that a cost that we Canadians should bear to have an independent Canada?

Will 2026 be Good??

Things were great in 2025 for the financial markets. Will 2026 be good? The current predictions by market strategists are for 9% equity market returns and nothing spectacular for the bond market. It is market lore not to “fight the Fed” and that “bull markets climb a wall of worry”. But we worry. We base our outlook on the prospects for risk and return and valuations are looking stretched to us. Evidence of credit market excess surfaces frequently and the mania in Private Debt still worries us. If the credit market implodes, then equities won’t be far behind.

We think Canada will have a difficult 2026 unless the U.S. Supreme Court rules against Trump’s tariffs and/or a quick trade deal is struck. Even then, the Steel, Aluminum, Lumber and Auto tariffs are under different legislation and would survive. The U.S. has put politically charged Canadian policies like streaming content and farm marketing boards in their trade sights so the USMCA negotiations will be difficult. Given Trump’s penchant for “deals” and rejection of free trade and multilateral organizations, renewal of USMCA is not assured.

We hope for the best but professionally must worry about the worst. With markets frothy and Canada under huge strain, it’s best to concentrate on valuations and be paid for the risks we assume.

Footnotes

- Source: The Washington Post. (2026, January 11). Running deficits larger than during the Great Depression is reckless.

- Source: Ward, Jasper. (2025, December 17). Trump says next Fed chair will believe in lower interest rates ‘by a lot’.

- Source: Swanson, Ana. (2026, January 3). Why Haven’t Trump’s Tariffs Had a Bigger Impact?

- Source: Board of Governors of the Federal Reserve System. (2023, November 8). Changes in U.S. Family Finances from 2019 to 2022.

- Source: Choi, Matthew and Merica, Dan. (2026, January 12). After Venezuela, Trump eyes Iran.

- Source: Atkins, Eric et al. (2025, November 30). Manufacturing meltdown.

- Source: Craig Brown, Robert. (2015, March 4). National Policy.

- Source: Smith, Fergal. (2026, January 2). Canadian factory downturn lengthens as new orders hit a three-month low.

- Source: SenateDemocrats. (2026, January 3). President Trump Discusses the Capture of Nicolás Maduro in Venezuela.