The Financial World Changed

It is sad to think that no matter what we write about it, what happened in the first quarter of 2025 will bear no relevance to what’s happening now. The announcement of the Trump Administration’s “Reciprocal Tariffs” on April 2nd, just 2 days after quarter end, changed everything. It reminds us of the 3rd quarter of 1987, when the October 19th Black Monday stock market crash of 22.6% happened just over 2 weeks later. It also is reminiscent of the 3rd quarter of 2008 when 3 weeks later in October the credit markets had ceased to function. Portfolio managers still visited their clients but what they were telling them about “performance” bore no relation to what had happened to their portfolios only a few weeks later. So, we will discuss what has happened since President Trump walked into the Rose Garden after the markets closed on April 2nd and unleashed an unprecedented assault on the global trading system.

A Fool’s Errand

As the saying goes, a wise man knows what he doesn’t know, a fool does not. We could opine on the economic and financial outcomes to the Trump Tariff Wars but trying to figure out what is actually happening with this attack on the existing global trading order is literally foolish. After Liberation Day was declared and the Trump Tariffs were announced, it was quite apparent that even Trump’s cabinet secretaries have no idea what the end game truly is. Some said it was part of Trump’s master plan to get leverage for “negotiations” and the tariff tumult would pass. Others said that there would be no relenting on the tariffs because they were part of Trump’s “liberation” of the U.S. economy.

Trump never admits to mistakes, but in between his weekend rounds of golf he reposted an opinion from X that suggested the stock market setbacks were planned and part of his grand economic strategy. That post suggested he was starting a global trading war to get interest rates lower for the U.S. housing market. That didn’t give one a lot of confidence that the Trump Tariffs were well thought out and planned. The White House press office, in a supreme moment of tone deafness, didn’t comment on the financial market meltdown but announced that Trump had won his match in his Golf Club’s championship!! Then the financial markets called Trump’s bluff.

Tariffs Meet Crashing Financial Markets

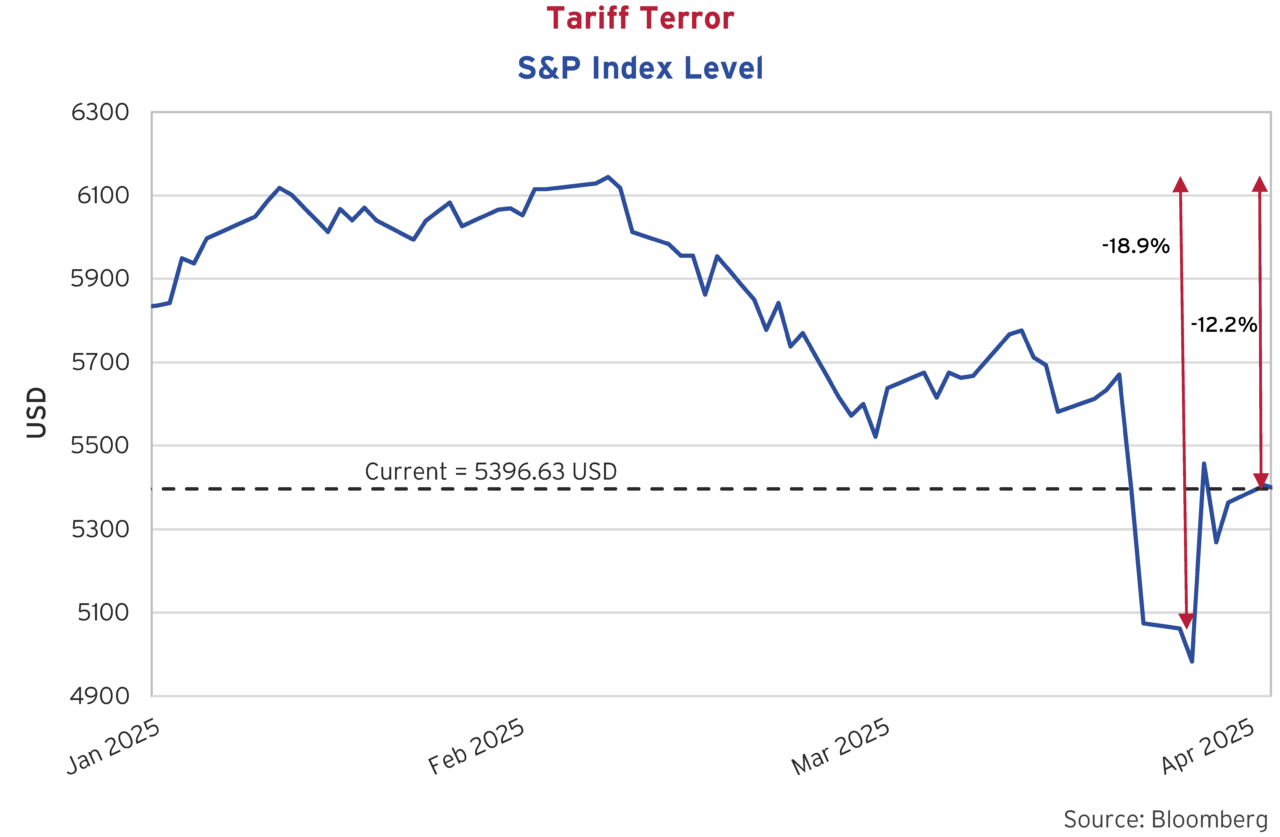

The equity markets crashed after the Liberation Day’s tariffs went into effect on April 3rd. The tariffs were much higher than expected and the S&P closed at 4983 on April 8th, down almost 20% from the post Trump inauguration high on February 19th at 6144.

By Wednesday, April 9th, the markets were still going down. Despite saying the markets were “a little yippy”, Trump blinked. That afternoon, under huge pressure, he suspended his most egregious “Reciprocal” tariffs for 90 days and the stock market soared in relief.

Ludicrous but Flexible Tariffs

That said, the 10% tariffs on all global goods and the 25% new auto tariff, the 25% Canada/Mexico fentanyl tariffs on goods that are not compliant with CUSMA and the 25% Canada steel and aluminium tariffs were maintained. In a move reminiscent of the movie Space Balls, Trump, from his Tariff Death Star in the Oval Office, demanded “Ludicrous Tariff Speed” on China instead of Warp Tariff Speed from his trade crew. China was then hit with a huge tariff increase of 145% for daring to impose its own counter-tariffs. Indeed, China, dropping the niceties of diplomatic language, declared these new tariffs “a joke” and said they wouldn’t further increase their tariffs beyond their 125% response. The stock market sold off on Thursday and remained choppy on Friday but managed to close up, with the S&P recording a 1.8% increase after being down slightly in the morning.

Oops!!

At that week’s end, in the media dead space of Friday night, the Trump Administration then announced that consumer electronics and its supply chain were exempted after a furious lobbying effort by Apple and other companies. Even the Taliban didn’t blow up the cellular networks during the Afghanistan conflict, fearing the popular backlash to the population from mobile “disconnection”. Faced with the politically dire consequences of the huge increases in mobile phone and computer prices that the manufacturers predicted, Trump backed down, appreciating that mobile devices were now “consumer essentials”. Of course, Mr. Trump trumpeted his backpedalling as a uniquely Trumpian quality:

““Look, I’m a very flexible person, I don’t change my mind, but I’m flexible,” Trump told reporters. “I helped Tim Cook recently and that whole business,” the president continued, referring to the Apple chief executive officer. “I don’t want to hurt anybody. But the end result is we’re going to get to the position of greatness for our country.””1

Trump doesn’t change his mind, but his beautiful tariffs were definitely going to hurt voters and companies, so he exercised his newfound “flexibility”. The problem with Trump’s Tariffs is that they don’t separate out the short- and long-term effects. Economists say the short term is when the “Factors of Production” can’t be altered. Mobile devices built in China with a supply chain and parts dependent on China can’t immediately be replaced by American produced equivalents. Yes, one can add an extra shift to a production line or build another if there’s room in the factory, but expanding production takes time. Labour is more expensive in the United States, if you can find it. If there’s no factories, that’s a problem.

Economists will tell you that the factors of production can be altered in the long run with new manufacturing capacity, thus adding to the supply curve. A brand-new factory will take at least a year to get up and running properly. Given that almost all consumer electronic and computer production has been offshored to China over the last 20 years, it is a rather tall order to replace it. That’s why Trump’s Tariffs on consumer electronics made in China were “temporarily” suspended.

What Happens Afterwards

The Trump Administration seems to want to break things. It is not clear that they have considered how to put them back together. Breaking the current global trading regime is easy by presidential decree with Trump’s wanton disregard for long established treaties, but the question is what happens afterwards. The current plan seems to be to negotiate bilateral tariffs with individual countries:

“Trump has made clear to his economic team that he wants to be personally involved in each negotiation – and that he plans to drive a hard bargain and secure tangible wins, even if his threshold or even parameters for that metric are a mystery to his top aides.”2

As always, Trump is alternating between bluster and threats to gain leverage in his “negotiations”. It is not clear what his threshold for economic and market pain really are, and what his goals will be. Even his senior trade and economic advisers point out their lack of control over Trump Administration policy:

“”My opinion is that there’s a variety of improvements that could take place,” Council of Economic Advisers Chair Stephen Miran said when asked for clarity earlier this week. “But at the end of the day the president is the decider and he’s gonna decide.”” 2

A reasonable question is what the “decider” will eventually decide, if he’s going to be the only person making decisions. If the past couple of weeks are a guide, even Trump does not know what he’s going to do and that’s little comfort to those along for the ride.

Trumping UNCERTAINTY!!!

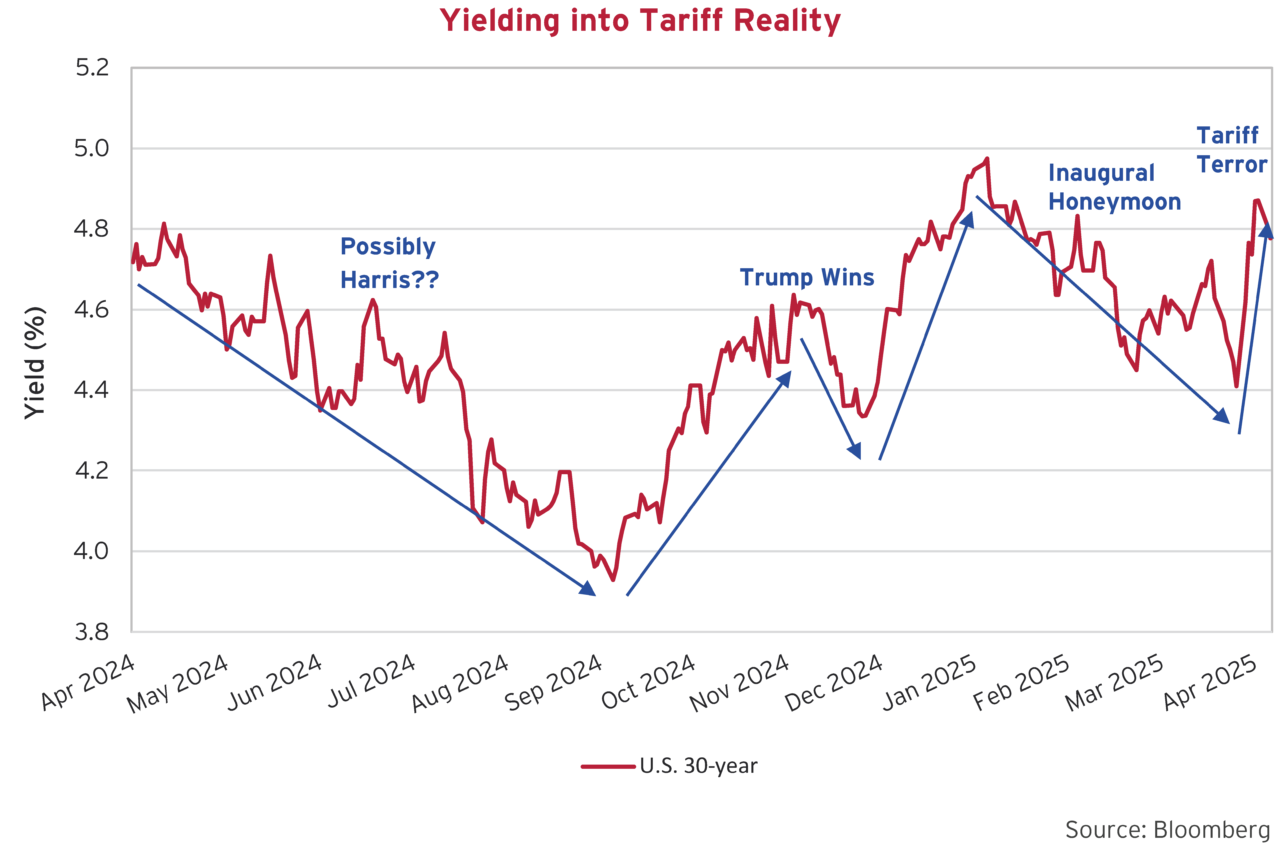

Uncertainty is not a friend to financial asset values and what we are very certain about is the current high levels of uncertainty in financial markets. This was brought about by the Trump Tariffs and by their ever-changing application, level and relief are causing immense economic harm. This is quite obviously Trump’s initiative, and he will own its aftermath. Perhaps the biggest reaction to the Trump Tariff tumult came from the bond market. Even before this tariff turmoil, Mr. Trump, the self-styled “King of Debt”, was not particularly beloved by bond investors as the chart below of the long Treasury yields shows.

The long Treasury yield was declining in early 2024, following post-pandemic inflation down. Once Kamala Harris replaced Joe Biden as the Democratic Presidential nominee and the prospects of a Democrat President improved, that yield decline accelerated, with the long Treasury bottoming at just under 4% on September 16th. When the electoral prospects of Trump improved, the yield increased into the election and then dropped before again increasing to nearly 5% at year end 2024. Every President has an inaugural honeymoon, and Trump had his second. People gave him the benefit of not believing he would actually apply the “BEAUTIFUL TARIFFS” he campaigned on, with yields falling to 4.5%. Yields then soared on “Liberation Day” towards 5% and are only down slightly in the continuing tariff turmoil afterwards. In normal Trump fashion, he has declared victory:

““The bond market’s going good. It had a little moment but I solved that problem very quickly,” he said.”3

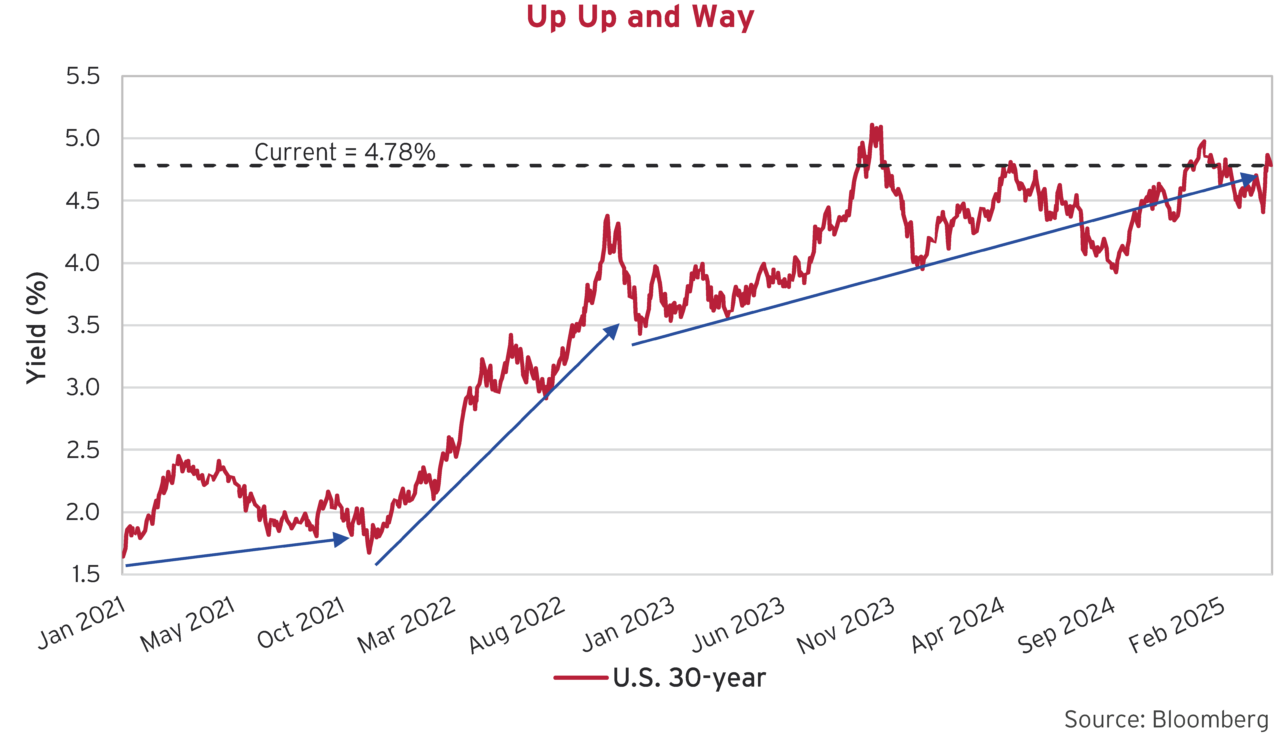

The bond market is not “going good”. The good news is that long Treasury yields are down slightly from the peaks, but the bad news is they seem stuck at higher levels. If we look at the Treasury yield for a longer period in the chart below, we see that the longer term trend has been upwards, and this is instructive.

Yes, the Trump trade war is raising inflation expectations and reducing belief in American Exceptionalism and perhaps the demand for U.S. financial assets, but the market has been reacting to the U.S. budget deficits for quite some time, whether they were Biden’s or Trump’s. As we have told you before, from the pandemic lows of nearly 1%, the long Treasury yield has moved in stages to 3% and has been steadily increasing to well above 4% since 2023. The recent jump is all Trump Tariffs, but the continuation of massive U.S. Federal government deficits is increasing the supply of Treasuries. The extension of the Trump tax cuts is not likely to be accompanied by an increase in other revenues or major cuts, despite Musk’s and Department of Government Efficiency (DOGE)’s best intentions, so there will likely be deficit spending and substantial Treasury issuance for many years to come.

If You Break It, You Own It

Despite Trump’s bravado and declaration of bond market victory, long Treasury yields are still near their highs. Consumer and business sentiment is plunging, and polls are showing that voters are now questioning Trump’s economic competency. Given his reluctance to admit to error, Trump now seems to be looking for ways to reduce the economic damage he has caused before his political capital suffers too much further. As he sees the jubilation that he expected turn to economic and financial fear, Trump is now musing about delaying other tariffs like auto parts.

Throughout history, many shooting wars start almost by accident, through miscalculation and raw human emotion. The First World War started with the assassination of the Archduke Ferdinand by a Serbian terrorist and caused the death of millions before it was finished. The need to mobilize your military reserves to match your enemies’ mobilization created a momentum of its own. This trade war seems to have got out of control for the Trump Administration, with allies and enemies alike questioning the flimsy rationale for such a grievous assault on the world trading order. It wasn’t perfect, but as they say in retail stores, “If you break it, you own it”.

A Political Economy

Trump’s goals from all this are not necessarily a bad thing. Many years ago, the disciplines of political science and economics were not “sciences” and were joined together as “Political Economy”. In modern economics, one is supposed to follow the numbers and clinically and dispassionately maximize the outcomes in a quantitative sense. Clearly, internationalism and global trade have advantaged some and hurt many others. If efficient markets and international finance dictate that individual countries, cities, factories and workers should not exist, then so be it. That works for those benefitting from globalism but leaves many others stewing in resentment.

Trump and other populist leaders have drawn upon this wellspring of resentment and gained power to redress these imbalances. Whether they will actually benefit their voters is a whole other question. The economic success of autocrats tends to be fleeting, whether they are left or right politically, as the desire for power and greed take hold. The very success of the western democracies stems from the rule of law, the idea that a person or a business doesn’t exist at the pleasure of the ruler who can capriciously act to the detriment of an individual, company or society as a whole.

The Desire to Dominate

A good opinion piece by Shadi Hamid in the Washington Post discusses that the desire for domination can overcome the desire for good economic outcomes. Despite his very obvious anti-Trump leanings, he points out that economist Adam Smith, the father of free market economic theories, wrote an essay on domination:

“To understand this shift, I’ve turned to an unlikely guide: Adam Smith. Yes, that Adam Smith, the presumed patron saint of free markets. In his lesser-known jurisprudence lectures, Smith described what he called the “love of domination and authority and the pleasure men take in having everything done by their express orders.” This desire, Smith believed, was so powerful it could overcome rational self-interest and persist even when economically disadvantageous. Sound familiar?”4

Perhaps the Trump Administration has fallen victim to the very human desire for domination that Adam Smith wrote of. It also could be that they are drunk on their power, reflecting the human biochemistry of “exuberant risk taking” that Professor John Coates described in his great book, “The Hour Between Dog and Wolf.” Whatever the explanation, the second Trump term is opening with more chaos and “Sturm und Drang” than anyone expected, other than possibly President Trump. Our point here is that the current tariff war repudiates years of efficient markets theory, financial economics, free trade and globalization.

It is Hard to Rebuild Trust

And there’s no going back to the way things were. As Canadians, we have witnessed the leader of a valued ally and trading partner suddenly turn to disparaging our country, threatening to inflict serious economic havoc to absorb our country. This is very offensive to many of us Canadians, and it has changed our electoral politics dramatically. The economic and political Trump threats come in the middle of an election campaign and are drowning out very real and pressing other issues like housing, immigration and health care.

As Canada and other countries question the value of their trade integration and treaties with the United States, China is taking advantage of the Trump trade mayhem. Chinese President Xi Jinping is now touring Southeast Asia in the aftermath of Liberation Day, showing his resolve in the face of the Trump Tariffs and suggesting perhaps China is a more amenable and reliable trading partner. President Trump responded that Xi’s tour was “a chance to “screw” the US.”

Trust is a hard thing to restore and there is not much sympathy for Trump’s complaint among allied countries, since they believe Trump is “screwing” them. Mr. Trump and his MAGA cronies should remember that sometimes you need your friends. By treating allies on the same basis as enemies, they have taught the rest of the world a lesson about the perils of overreliance on the United States. This is what the Canadian military used to describe as a “self-inflicted injury” or what athletes call an “Own Goal”.

Chest Beating and Brick Walls

As we said at the start, it is impossible to predict or divine where all this Trump Tariff tumult will end. Risk has reared its ugly head, and the jubilation of the post pandemic market frenzy has now run into the Trump Tariff brick wall. Like the start of a shooting war, there’s lots of patriotic chest beating and parades before the actual combat results in casualties from this trade war. We don’t know what will eventually happen, but fortunately, we have been selling into strength for a few years now, expecting the jubilant and bubbly markets post-pandemic would eventually end.

This has put our portfolios into higher quality and better valued securities, with the exception of our normal value plays and special situations. That doesn’t mean that our portfolios aren’t exposed to the downdraft, as illiquidity affects even the best and/or the cheapest securities. Corporate bond yields spreads were far too tight for our liking, and that means our sales were invested in government bonds and Mortgage Backed Securities. Our equity portfolios have substantial cash positions.

When to Buy??

When is it time to buy?? That’s the real question and so far, we have not seen the major distress and illiquidity that we would have expected to see given the potential huge impact of the U.S. tariffs that have been announced. Certainly, a leveraged business operating on 10% margins cannot absorb and function with even the reduced tariffs we are now seeing. If sustained, they will inevitably be passed through to end consumers, not to mention the havoc on global supply chains. We continue to take advantage of opportunities and await further developments on the “Political Economy” front.