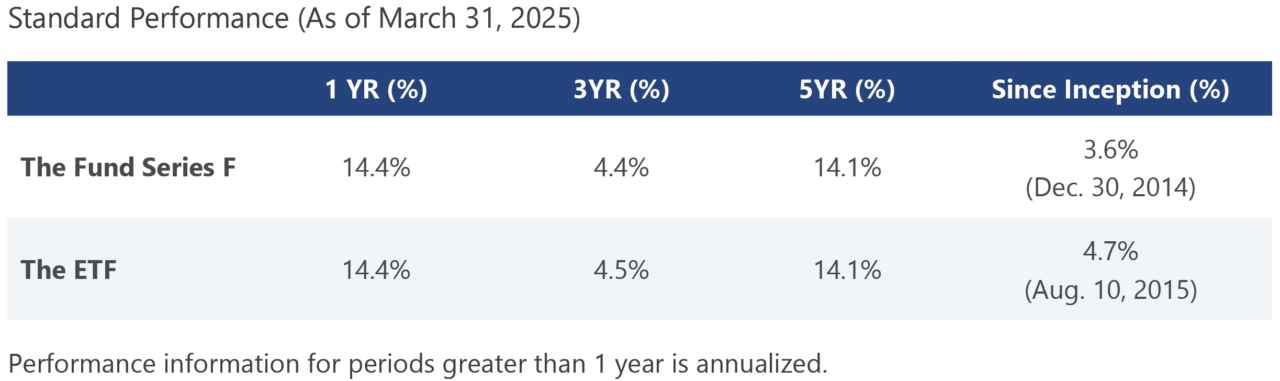

The Canadian Preferred Share market had a positive quarter to begin 2025 with the S&P/TSX Preferred Share Total Return Index (the “Index”) up 2.1%. Series F of Lysander-Slater Preferred Share Dividend Fund (the “Fund”), and Lysander-Slater Preferred Share ActivETF (the “ETF”), (Ticker: “PR”) were up 1.7%, respectfully for the quarter.

The Bank of Canada (“BoC”) lowered the overnight rate 25bps twice to 2.75%, and the U.S Federal Reserve (“Fed”) held their overnight rate in the range of 4.25% – 4.5%. Ongoing tariff threats against Canadian imports into the U.S caused U.S equity market volatility in the quarter, however both the Canadian equity market (“XIU”) and Canadian Preferred Shares were positive. The current 5-year bond yield in Canada is at 2.6% which we believe is still an attractive level for upcoming fixed rate reset Preferred Shares.

Canadian Preferred Share redemptions continued to support market performance with 7 issues being redeemed for an approximate value of $1.7 billion. Fairfax was the biggest surprise as they decided to call in three issues which included their 216bp fixed rate reset (FFH.PR.E). We anticipate approximately $2.75 billion more of Preferred Shares to be redeemed by the end of 2025 which should continue to support market performance.

Heading into Q2, we expect potential market volatility due to geopolitical risks mainly being the U.S planned tariffs against Canada and many other countries. As a result, we have been positioning the Fund and ETF defensively by owning approximately 39% in high spread/coupon $1000 Preferred Shares, and an approximate 23% weighting in cash and equivalents (treasury bills). We’ve also positioned the Fund & ETF with an 18% weighting in straight perpetual Preferred Shares that should perform relatively well in a falling interest rate environment. Depending on the severity of the tariffs imposed on Canada and length for which they are imposed, we expect the Bank of Canada to cut rates several times in 2025, however we believe that the Fund and ETF are well hedged for capital preservation should that occur.

- Bloomberg Finance L.P.